Yes, homeowners insurance covers wind damage to roofs in most policies. You can claim wind damage by documenting the destruction, contacting your insurer within 24-72 hours, and working with a licensed contractor. Most claims pay out between $5,000-$15,000 after deductibles.

Does Insurance Cover Wind Damage to Roof?

Yes, standard homeowners insurance policies cover wind damage to roofs. According to the Insurance Information Institute, HO-3 policies list windstorm as a covered peril, meaning your roof repairs from wind damage are typically covered.

What Wind Damage Insurance Covers

Your policy pays for:

- Torn or missing shingles from wind gusts

- Damaged flashing around chimneys and vents

- Broken gutters and downspouts

- Structural damage to roof decking

- Emergency repairs like tarping

- Interior damage from wind-created openings

When Insurance WON’T Cover Wind Damage

Coverage may be denied if:

- Your roof had pre-existing damage before the storm

- You neglected basic maintenance (rotted wood, years of uncleaned gutters)

- Damage occurred before your policy started

- You’re in a coastal area without separate windstorm insurance

Coastal Exception: Florida, Texas, Louisiana, and Carolina residents often need separate windstorm policies from state programs like Citizens Property Insurance or Texas Windstorm Insurance Association.

Can You Claim on Insurance for Wind Damage? Understanding Eligibility

You can file a wind damage claim if:

Wind speeds reached 50+ mph (NOAA threshold for roof damage)

Damage occurred during your policy period

Your roof was in good condition before the storm

You report within policy deadlines (typically 24-72 hours)

How Much Roof Damage for Insurance Claims?

There’s no minimum damage requirement. Even a few missing shingles qualify. However, consider these factors:

Small Damage (Under $2,000):

- Repairs might not exceed your deductible

- Filing could raise future premiums

- May be better to pay out-of-pocket

Moderate to Severe Damage ($2,000+):

- Almost always worth filing

- Insurance covers costs above deductible

- Prevents secondary water damage

Cost Example:

- Repair estimate: $8,000

- Your deductible: $1,500

- Insurance pays: $6,500

- Filing makes financial sense

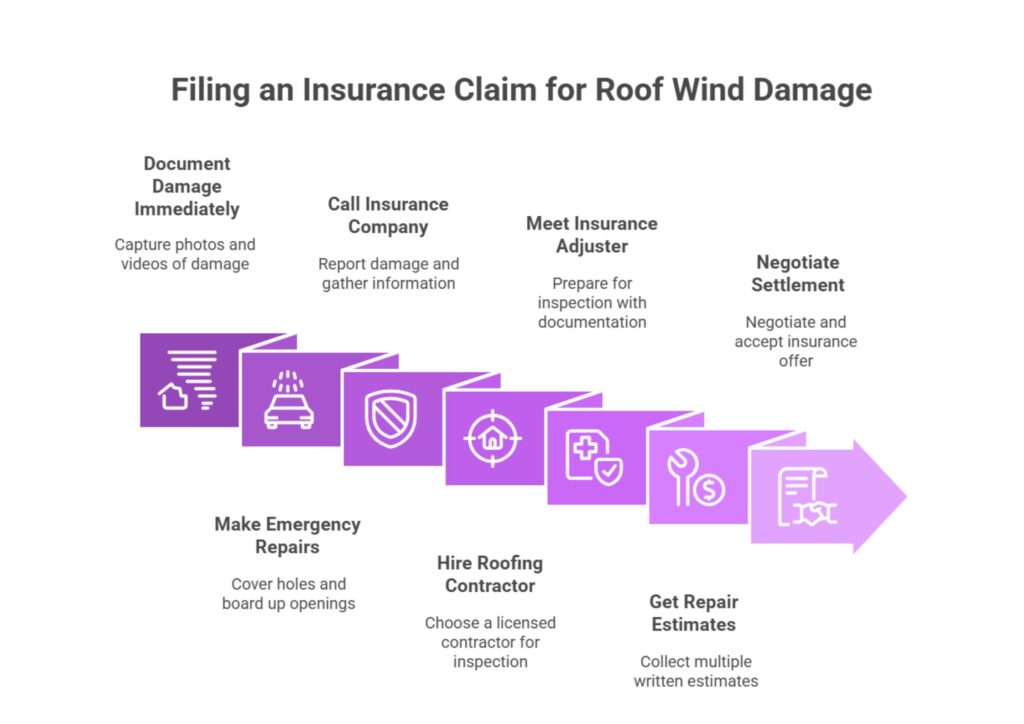

How to File an Insurance Claim for Roof Wind Damage: 7 Steps

Step 1: Document Damage Immediately (Day 1)

From the Ground:

- Take wide-angle photos of entire roof

- Capture close-ups of missing/lifted shingles

- Photograph shingles in yard or gutters

- Record date/time stamps on all images

Inside Your Home:

- Check attic for water stains with flashlight

- Look for daylight through roof decking

- Inspect ceilings for water marks or bubbling paint

- Document all interior damage

Video Walkthrough:

- Record 360° view around property

- Narrate what you’re showing (“these shingles blew off during yesterday’s storm”)

- Include date/time in your narration

Step 2: Make Emergency Repairs Only (Day 1-2)

Allowed temporary fixes:

- Cover holes with tarps (save receipts)

- Board up openings

- Place buckets under active leaks

WARNING: Don’t make permanent repairs before adjuster inspection. You could void your claim if damage can’t be verified.

Step 3: Call Your Insurance Company (Within 24-72 Hours)

Have This Information Ready:

- Policy number

- Storm date and approximate wind speed

- Description of visible damage

- Whether you’ve made emergency repairs

What to Say: “I’m reporting roof damage from wind on [date]. I have photos and need to file a claim. What’s my claim number and next steps?”

Get in writing:

- Claim number

- Adjuster’s name and contact

- Inspection date

- Policy notification deadline

Step 4: Hire a Licensed Roofing Contractor (Day 2-3)

Choose a contractor who:

- Has active state licensing

- Carries liability and workers comp insurance

- Specializes in insurance claims

- Provides written estimates

Get a Professional Inspection Report:

- Detailed damage locations

- Professional photos

- Preliminary cost estimate

- Expert assessment of cause (wind vs. wear)

Red Flags to Avoid:

- Promises to “waive your deductible” (insurance fraud)

- Requires full payment upfront

- Won’t provide written estimates

- Pressures immediate signing

Step 5: Meet the Insurance Adjuster (Day 3-10)

Prepare for Inspection:

- Have your contractor present if possible

- Organize all documentation (photos, videos, inspection report)

- Show maintenance records (proves good condition)

- Walk adjuster through every damaged area

What Adjusters Look For:

- Whether damage matches reported storm

- Roof condition before damage

- Pre-existing problems

- Signs of neglect

⚠️ Don’t accept verbal estimates. Wait for written assessment.

Step 6: Get Multiple Repair Estimates (Day 5-14)

Collect 3 written estimates including:

- Material costs (shingles, underlayment, flashing)

- Labor costs

- Disposal/cleanup fees

- Timeline for completion

Compare to Insurance Assessment: If contractor estimates exceed insurance offer by 20%+, you need to negotiate.

Step 7: Negotiate and Accept Settlement (Day 14-30)

If the offer is too low:

- Submit additional contractor estimates

- Request re-inspection

- Hire a public adjuster (charges 10-20% of settlement, but increases payouts by average of 747%)

- File a formal dispute

Before accepting:

- Verify amount covers all necessary repairs

- Understand if it’s replacement cost or actual cash value

- Confirm payment schedule (initial + final after completion)

Wind Roof Damage Insurance Claim: What to Expect for Payouts

Average Settlement Amounts (2025)

| Damage Level | Typical Cost | After $1,500 Deductible |

| Minor (few shingles) | $2,000-$4,000 | $500-$2,500 |

| Moderate (section damage) | $5,000-$10,000 | $3,500-$8,500 |

| Severe (multiple areas) | $10,000-$20,000 | $8,500-$18,500 |

| Full replacement | $15,000-$30,000 | $13,500-$28,500 |

Replacement Cost vs Actual Cash Value

Replacement Cost Coverage (Better):

- Pays full cost to replace with new materials

- Example: $10,000 damage – $1,000 deductible = $9,000 payout

Actual Cash Value Coverage:

- Deducts depreciation based on roof age

- Example: $10,000 damage on 10-year-old roof (50% life used) = $5,000 value – $1,000 deductible = $4,000 payout

Special Deductibles

Hurricane/Windstorm Deductibles (Coastal Areas):

- Percentage-based: 2-5% of dwelling coverage

- Example: $300,000 home with 2% deductible = $6,000 deductible

- Only applies when National Weather Service declares hurricane

How Long Does a Wind Damage Claim Take?

Simple Claims: 2-4 weeks

- Day 1-2: File claim

- Day 3-7: Adjuster inspection

- Day 8-14: Assessment processed

- Day 15-28: Settlement and payment

Complex Claims: 1-3 months

- Disputed damage extent

- Hidden damage discovered during repairs

- Large settlements requiring senior approval

- Post-major storm backlogs

Speed Up Your Claim:

- Respond to all requests within 24 hours

- Keep documentation organized

- Follow up weekly on pending items

- Don’t wait for insurance to contact you

Maximize Your Wind Damage Insurance Payout: Pro Tips

1. Document Everything Before AND After

- Take photos of roof condition during regular maintenance

- Keep receipts for all roof work

- Save storm date/wind speed data from NOAA

2. Use Insurance-Specific Language

Instead of: “Some shingles are missing”

Say: “Wind-driven forces caused mechanical failure of shingle adhesion in a 10×15 foot area on the south-facing slope”

3. Know Your Rights

You can:

- Choose your own contractor (never required to use insurer’s list)

- Dispute low assessments

- Request multiple re-inspections

- Hire a public adjuster at any time

4. Get Expert Help When Stakes Are High

Hire a Public Adjuster if:

- Claim exceeds $10,000

- Insurance denies your claim

- Settlement is 30%+ below estimates

- You don’t understand policy language

Cost: 10-20% of final settlement

Benefit: Average 747% higher payouts (per National Association of Public Insurance Adjusters)

Common Wind Damage Claim Mistakes to Avoid

Waiting to file – Report within 24-72 hours or risk denial

Making permanent repairs first – Adjuster can’t verify damage

Accepting first offer – Initial offers average 30-40% below actual costs

Not reading your policy – Know your coverage type and deductible

Skipping professional inspection – DIY assessment misses hidden damage

Poor documentation – “No photos = no proof” in claims

Ignoring maintenance – Years of neglect = denied claims

FAQ: Wind Damage Insurance Claims

Q: Can I file a claim for wind damage if I don’t see missing shingles?

A: Yes. Wind damage includes lifted shingles, cracked flashing, and hidden damage. Get a professional inspection even without visible missing shingles.

Q: Will my rates go up after a wind damage claim?

A: Not usually. Weather-related claims rarely increase premiums. Filing multiple claims within 3 years may impact rates.

Q: What if damage appears weeks after the storm?

A: File immediately upon discovery. You’ll need to prove damage occurred during a specific storm event. Save weather data from that date.

Q: Can insurance force me to repair instead of replace?

A: Adjusters determine if repair or replacement is appropriate. If damage affects 25%+ of roof, full replacement is usually approved.

Q: What if my roof is 20+ years old?

A: Age doesn’t disqualify claims, but payout depends on coverage type. Replacement cost policies pay full amount; actual cash value policies deduct depreciation.

For additional resources, visit the Insurance Information Institute (www.iii.org) or National Association of Insurance Commissioners (www.naic.org).