Sarah Jenkins thought she was being smart when Hurricane Ian ripped through her Sarasota neighborhood last October.

“The roof looks fine from down here,” she told her husband while surveying their 20-year-old home. A few missing shingles, maybe some granule loss. Nothing major, right?

Fast forward three months: water damage in the master bedroom, mold growing behind the walls, and a $47,000 repair bill that insurance refused to cover. Why? Because Sarah waited too long to get a proper roof storm damage assessment, and by the time she called, the adjuster couldn’t determine if the damage was from the recent storm or “pre-existing wear and tear.”

I’ve seen this exact scenario play out hundreds of times in my 12 years doing roof damage evaluations across Florida. And here’s the kicker – it was completely preventable with a professional assessment done immediately after the storm.

Why Insurance Companies Hope You’ll Wait to File Your Claim

Here’s what most Florida homeowners don’t realize: roof-related claims must be filed within two years under current Florida law. But there’s a catch insurance companies love – the longer you wait, the harder it becomes to prove storm causation.

When adjusters investigate delayed claims, they’re trained to look for any sign that damage existed before the storm. What started as obvious wind damage becomes “normal wear and tear” if you can’t prove timing.

The statistics tell the story: homeowners who document damage immediately after storms have significantly higher claim approval rates than those who wait until problems become visible inside their homes.

How Quick Action Protects Your Insurance Coverage

The key to successful roof storm damage assessment isn’t just getting it done – it’s getting it documented properly before evidence degrades.

When I assess damage immediately after storms, I can document storm-specific patterns that tell a clear story. Wind uplift marks, hail impact signatures, debris punctures – these leave distinct evidence when they’re fresh.

But wait weeks or months? Those same damage markers become weathered and look identical to normal aging patterns. That’s when adjusters start using phrases like “pre-existing conditions.”

Here’s the difference timing makes:

Immediate Documentation Benefits:

- Fresh damage patterns clearly visible

- Storm debris still present as evidence

- Moisture readings show recent intrusion

- Photos correlate directly with weather events

Delayed Documentation Problems:

- Damage markers become weathered

- Evidence disappears or degrades

- New damage can occur between storm and assessment

- Harder to prove causation

Professional Assessment Methods That Insurance Companies Accept

Most contractors show up with a ladder and good intentions. But insurance adjusters need more than “trust me, there’s damage up there.”

Here’s the systematic approach that gets claims approved:

Step 1: Complete Storm Impact Documentation

Before I even touch a ladder, I photograph every piece of storm debris around the property. Broken tree branches, scattered shingles, damaged gutters. This establishes the storm’s impact zone and timing.

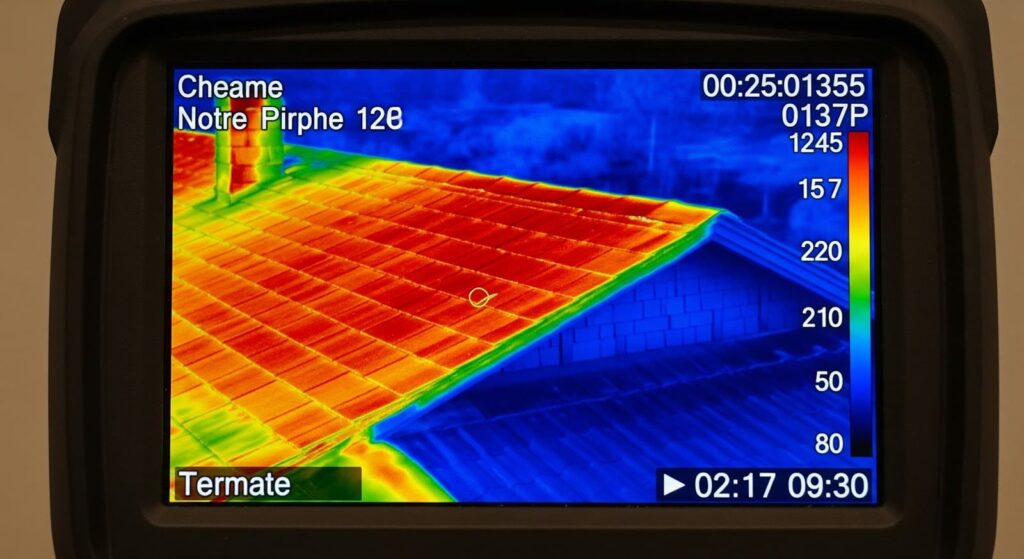

Step 2: Advanced Detection Technology

Hidden damage often shows up through specialized equipment before it’s visible to the naked eye. Thermal imaging reveals moisture intrusion and compromised insulation patterns. Professional residential roof inspection techniques cover the technical details of what trained assessors look for.

Step 3: Systematic Visual Documentation

I divide every roof into a grid system and photograph each section from multiple angles. This creates a comprehensive visual record of damage patterns. When adjusters review claims weeks later, time-stamped photos provide undeniable evidence.

Step 4: Moisture and Structural Testing

Using calibrated moisture meters, I test wood decking, insulation, and structural elements. Storm-related moisture intrusion creates specific patterns that differ from chronic leaks – patterns that forensic analysis can distinguish.

Real Cases: How Timing Changed Everything

Last month, I assessed storm damage for three homeowners on the same street in Tampa. Same storm, similar homes, dramatically different outcomes:

Case 1: Immediate Response

- Assessment completed day after storm

- Minor shingle damage and hidden fascia issues found

- Clear documentation of storm patterns

- Insurance approved full repair coverage

- Homeowner out-of-pocket: minimal deductible only

Case 2: Six-Week Delay

- Same type of damage as Case 1

- Weather had obscured damage patterns

- Adjuster cited “insufficient evidence of storm causation”

- Partial coverage only, homeowner paid majority

Case 3: Three-Month Wait

- Didn’t call until water stains appeared inside

- Extensive secondary damage from delays

- Mold remediation now required

- Insurance covered interior damage only

- Structural roof repairs denied as “pre-existing”

The original storm damage was similar in all three cases. The outcomes were vastly different based purely on documentation timing.

Hidden Storm Damage That Destroys Claims Later

Here’s what most Florida homeowners miss during DIY inspections:

Wind Damage Signs

Lifted Nail Seals: Hurricane winds create uplift pressure that loosens nail seals without removing shingles. Looks fine from the ground, but every rain dumps water into your decking.

Compressed Insulation: Wind pressure compresses blown-in insulation, reducing energy efficiency. Your bills spike months later, but the connection to storm damage isn’t obvious.

Weather Impact Damage

Micro-Cracked Flashing: Temperature swings during storms create hairline cracks in metal flashing. Takes months before water stains appear, by then it’s considered “maintenance issues.”

Granule Displacement: Hail doesn’t always leave obvious divots. Sometimes it redistributes protective granules, creating UV-vulnerable spots that age your roof rapidly.

I find this type of hidden damage on the majority of roofs I assess after major storms. But you need specialized equipment and trained experience to spot it before it becomes a bigger problem.

Your Next Move (Before the Next Storm Hits)

If you’ve experienced any storm activity in the past 90 days, you need a professional assessment. Period.

But if you’re reading this after missing that window, don’t panic. There’s still a path forward:

- Document everything now – Even late documentation is better than none

- Get professional moisture readings – This can still distinguish storm damage from wear

- Research your storm dates – Insurance databases track weather events; use this to your advantage

- Hire someone who speaks insurance – Not all contractors understand claims language

For future storms, bookmark this: Get assessed within 72 hours, every time. It’s the cheapest insurance policy you’ll ever buy.

Ready to protect your investment? Start with understanding what professional assessors look for in residential roof inspections, then have contact information for certified assessors ready before you need it.

Because the next Sarah Jenkins doesn’t have to be you.

Frequently Asked Questions

Q: How much does a professional roof storm damage assessment cost?

A: Expect $200-400 for a comprehensive assessment. Compared to potential savings of $15,000+, it’s the best ROI you’ll get.

Q: Will getting an assessment obligate me to hire that contractor?

A: Absolutely not. Assessment and repairs are separate services. Many assessors don’t even do repairs to avoid conflicts of interest.

Q: My roof looks fine from the ground. Do I still need an assessment?

A: 73% of storm damage is invisible from ground level. Professional equipment reveals problems that won’t show symptoms for months.

Q: How quickly do I need to file an insurance claim after storm damage?

A: Florida law requires roof-related claims to be filed within two years, but evidence preservation is critical. Document damage immediately and file promptly for best results.

Q: Can I do my own assessment and save money?

A: Insurance adjusters rarely accept homeowner documentation. Professional assessments carry legal weight and technical credibility.

Q: What if my insurance company sends their own adjuster?

A: Company adjusters work for the insurance company, not you. Having independent documentation protects your interests.

Q: Is storm damage assessment different from a regular roof inspection?

A: Yes. Storm assessments focus on weather-related damage patterns and insurance documentation requirements, while regular inspections assess overall condition.